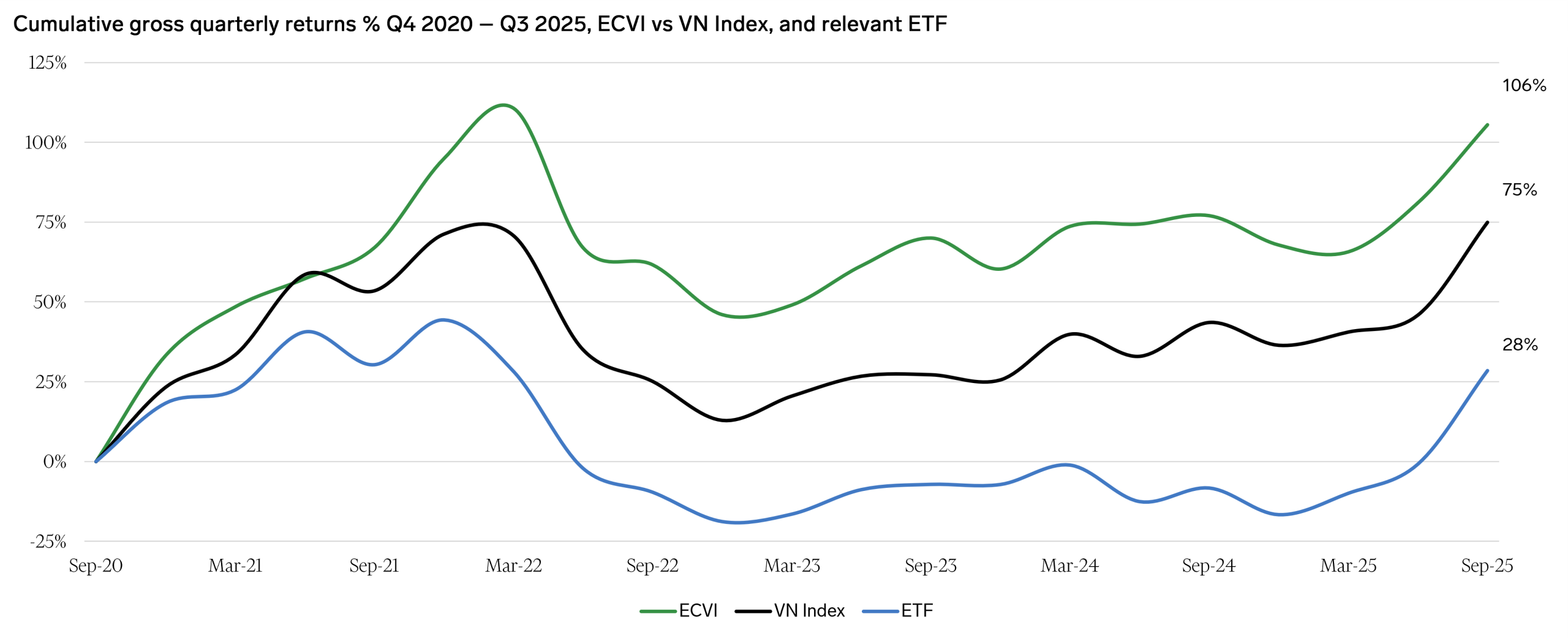

Endurance Capital Vietnam I has over time significantly outperformed both the VN Index and the relevant ETF

Endurance Capital's concentrated portfolio consists of approx. ten long-term compounding high quality companies where we see deep value potential over the typical holding horizon of ca. 5 years.

Endurance Capital’s strategy is both evergreen and semi-liquid - effectively ensuring a long-term strategically advantageous capital structure, which allows keeping liquidity available in times when the market hits a trough, while at the same time providing the foundation for building long-term working relationships with our holdings around impactful value enhancement programs.

During Q3 2025 the strategy delivered a return of c. +13% USD gross. Over the past 5 years the strategy has outperformed the VN Index by +31%-points and the relevant ETF by +77%-points over the same time period. The outperformance was produced at a lower than market risk level (beta 0.8).

Endurance Capital Vietnam II SICAV-RAIF S.A

In April 2023, we launched Endurance Capital Vietnam II SICAV RAIF – our new fund, based in Luxembourg. Endurance Capital Vietnam II (ECVII) is set up with three regular share classes and purposed for professional individual and institutional investors. It is launched with the highly attractive and temporary share class V which offers lower fees for investors joining ECVII early in its journey. The new fund is a parallel entity to ECVI, with the two funds having the same strategy and being run by the same team, as well as over time invest pro-rata in the same portfolio holdings. Both funds are open once per month for investment. If you are interested to learn more, please send an email to: [email protected]